Organic Fruit puree – The overview

The demand for organic fruit puree has been on the rise over recent years due to the awareness of its health benefits and nutritional values. The term organic refers to the way the fruits are grown and harvested. The regulations for organic fruit puree vary from country to country. However, in most countries, organic fruits must be grown without the use of herbicides, synthetic pesticides and fertilizers. The organic production of fruits involves a combination of using natural fertilizers and best environmental practices. Organic farming improves the quality of the soil, reduces pollution and helps in conserving groundwater levels.

Organic fruit purees are manufactured from organic fruits that are naturally ripened and grown without the use of harmful chemicals. Our organic fruit purees are manufactured from organically certified farms. Our organic fruit purees are certified by the EU, USDA, and JAS certification bodies. A product can be claimed organic only when the certification bodies evaluate the manufacturers and issue a certificate to label their product as organic.

The difference between conventional and organic fruit cultivation lies in the origin of fertilizers and pesticides. Pesticides and fertilizers must be of “natural origin” in organic fruit cultivation. For instance, the pesticides must be products that can be extracted from natural minerals such as mineral copper sulfate. However, pesticides can be synthetic in traditional farming which is manufactured in laboratories.

Organic fruits produced in India

Organic fruit production excludes the inputs from modern farming practices, most notably fertilizers and synthetic pesticides. Organic fruit production depends on many factors such as crop residues, crop rotation, animal manure, organic wastes and biological pesticides. This improves soil fertility and helps to control weeds, insects and other pets.

Some of the organically grown fruits in India include Guava, Mango, Papaya, Pineapple, Banana, Apple, lychee, avocado and citrus fruits. Organic fruit production in India improves the market for organic fruit puree and pulp. The subtropical fruits witness a gradual increase in organic cultivation, due to the favourable climatic conditions in India. This increased the scope for organic fruit drinks that in turn increases the market for organic fruit pulp. Tropical fruits are dominating the fruit puree market compared to the other fruits.

Organic Fruits processed

The demand and growth of organic fruit drinks and organic fruit puree have grown at a steady state over the last five years. The fruit drink market can be classified into fruit drinks (fruit content up to 30%), nectar drinks (fruit content between 25-90%) and fruit juices. (100% fruit content).

Fruit drinks are the largest market in the beverage industry with a market share of 50-60%. Mango puree based drinks are the most popular and preferred flavour among the consumers that contributing to 90% of the volume. The pineapple puree flavour shares a 3% share and the remaining is shared by the fusion of one or two flavours.

The fruit juice market share is around 30% and is expected to grow by 25-30% annually. The rising number of health-conscious customers is the key factor that will drive growth in the fruit juice market. Organic pink guava puree and organic white guava puree are gaining popularity in India, the US and European markets due to their applications and numerous health benefits. Papaya puree with mango fusion is also preferred by consumers and fruit drink manufacturers. Nectar based drinks get a market share of 10% in India. This industry is also expected to grow since nectar drinks don’t contain any additives or preservatives.

Organic farming growth in India

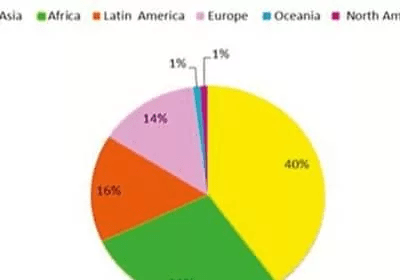

Organic fruit farming is in the incipient stage in India. The number of organic producers around the globe and in India increases considerably. As per the 2017 reports, Asia contributes to the highest proportion of organic fruit production (40%) in the world. India holds the largest number of organic producers in the world with several 835000 producers.

According to the Union Ministry of Agriculture and Farmers’ welfare, about 2.7 million hectares of farmland were under organic cultivation in March 2020. This represents 2% of the total net sown area of 140.1 million hectares. A few states have taken a lead in organic fruit production and Madhya Pradesh tops the list with 0.76 million hectares under organic fruit farming. Maharashtra, Rajasthan and Madhya Pradesh account for 50% of the area under organic fruit production. The top 10 states contribute to 80% of the total organic cultivation in India.

Organic farming regulation – labels and standards

The USDA label refers to the verification of organic products in terms of USDA organic guidelines which define the basic criteria that must be validated by a USDA certification agent before a product can be labelled as organic. The Indian organic certification ensures the raw materials used for growing the products should be free from synthetic pesticides. Organic farming regulation also includes testing of soil, water, and fruits from the organic farm. It should not contain any harmful pesticides and heavy metal residue.

In the European Union standard, the European certification also guarantees other parameters such as conservation of soil fertility, preservation of biodiversity and transparent labelling. To obtain the EU logo, the products must be certified by a certification agency to attest to their compliance with European organic regulations.

Organic Fruit purees and concentrate that we offer

Organic fruit puree production seems to be an ecofriendly method of production. Organic foods are chosen because people want to avoid toxic chemicals. Organic fruit pulps are grown with minimal interference to the environment and support healthy living. Since harmful chemicals are not used in organic farming, there is minimum pollution of soil, water, and air ensuring a safer and healthier environment.