Mango crop failure in Peru

Peru mangoes fetch a great demand in the USA market. Unfortunately, Peru is experiencing a 70-80% reduction in mango volumes this year. Casma valleys, Ancash, and Lambayeque are the primary cultivating regions in Peru. As a result of the El Niño phenomenon, mango cultivation regions in Peru experienced heavy rainfall. The rainfall affected the Peruvian mango flowering, slashing the production volumes. There are no issues with the quality and size of the Peruvian mangoes. It is similar to the previous years. However, the adverse effects of the flowering diminished the volumes of Peru mango, with few farms experiencing zero production.

This mango crop failure situation also prevails in other South American countries like Ecuador and Brazil. As per the reports, Ecuador is witnessing only 30% flowering, and there will be no fruits for export. This shortfall of Peru mango created a demand for mango-processed companies in India.

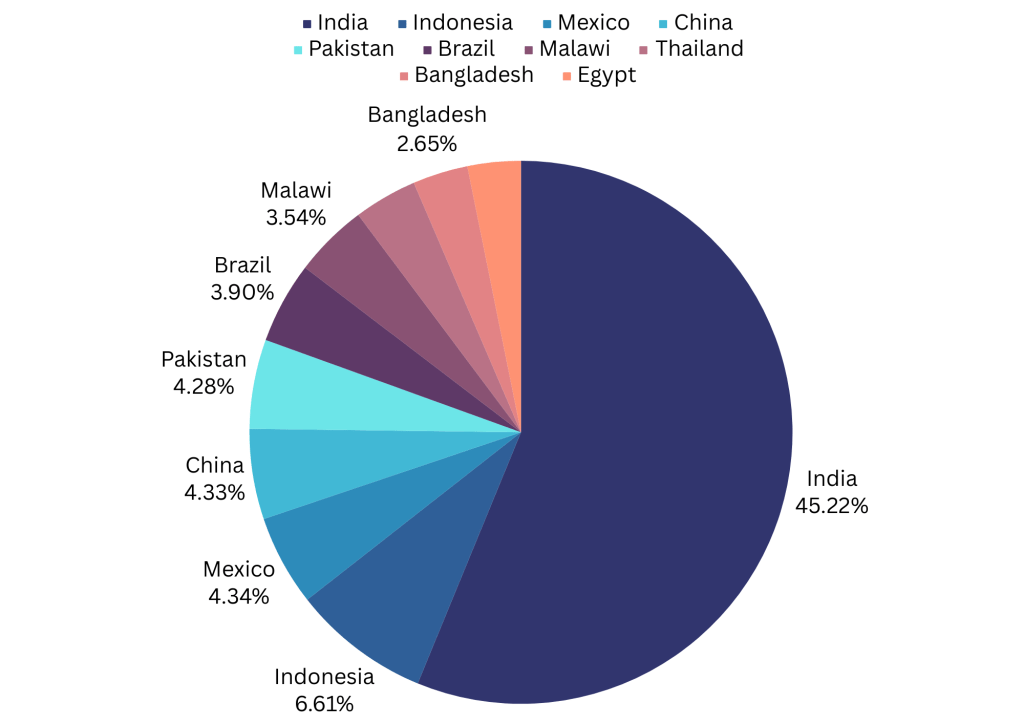

Since most of the Peruvian mangoes experience a shortfall due to the El Nino phenomenon, this opens a new opportunity for the mango processing industries in India. India is the largest producer of mangoes, contributing to 50% of global production is equipped to address the demand.

We had a good crop this 2023 season with high yield, low costs & good quality. Read our mango crop report here: https://www.abcfruits.net/mango-crop-report-2023-alphonso-totapuri-mango-season-2023/.

Impact of the Peruvian mango crop failure

- Consumption of mango and mango processed products has increased in North America dramatically in the past 5 years as consumers have a new interest in tropical flavours.

- The crop failure of Peru mangoes leaves a void between demand and supply of mango requirements for America.

- Some customers are actively looking for alternatives to Peruvian mangoes in the market. However, some of them are reducing their total usage/consumption of mango.

- The implications of reduced consumption will have long-term effects as consumer preferences adapt to new market offerings. This will reduce the use of Peru mango or the importation of other mango varieties.

How India can address mango requirements in South America

There are more than 1000 varieties of mango cultivated in India. However, only a few varieties are used for processing, and the remaining varieties are consumed domestically. As per reports, only 7% of the mangoes are processed. This puts up a lot of scope and opportunities for Indian mango processors to address the global demand.

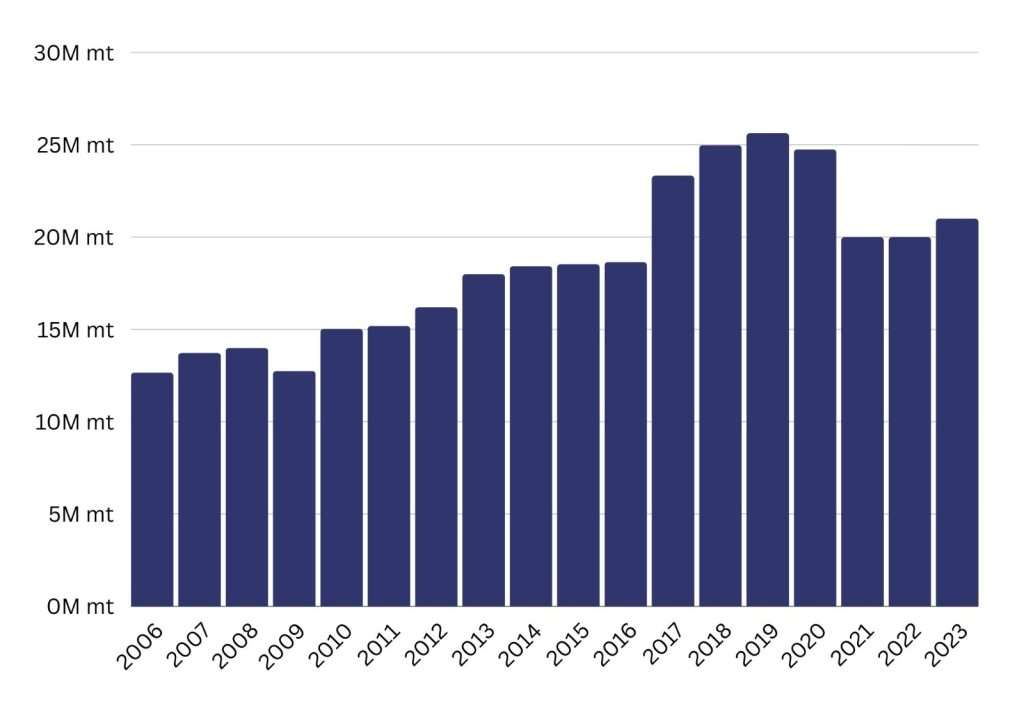

Mango production in India 2023

It is estimated that India produced more than 21 million metric tonnes of mango in 2023, half of the global production. India has witnessed a consistent rise in mango production over the last few years and is expected to increase in the coming years.

We had good mango production in 2023 with high yield, low costs & good quality. Read our mango crop report here: https://www.abcfruits.net/mango-crop-report-2023-alphonso-totapuri-mango-season-2023/.

There are approximately 150 mango processing plants in India. However, the main processing clusters are located in Krishnagiri and Tirupattur. There are around 75 processing industries in this region alone.

India has been in the mango processing industry for over 30 years. Since the demand for value-added products increased, followed by technological advancements in the early 2000s, India became a global leader in mango pulp production.

Increase Mango growing and cultivation areas

As per Statista, the cultivation area available for mango is estimated to be 2.3 million hectares. Most processing varieties are grown in Tamil Nadu, Andhra Pradesh and Karnataka. As per the Department of Horticulture Tamil Nadu, Mango tops the list and holds nearly 53% of the total fruit area followed by Banana, lemon, and Guava.

Karnataka and Andhra Pradesh are also improving the production area consistently. With consistent increases in cultivation area, good processing varieties and quality measures are paving the way for India to spearhead the global market.

Processed mango growing areas

| Varieties | Growing/ Cultivating areas |

| Alphonso | Karnataka (Mysore, ChannaPatna, Bangalore belt), Tamil Nadu, Maharashtra |

| Totapuri | Andhra Pradesh, Karnataka, Tamil Nadu |

| Neelam | Tamil Nadu, Karnataka, Andhra Pradesh |

| Kesar | Gujarat, Western India |

Mango comparison chart: Indian vs Mexican mango vs Peruvian mangoes

| Characteristics | Alphonso (India) | Totapuri (India) | Neelam (India) |

Kent (Peru) | Tommy Atkins (Mexico) |

Magdalena River (Columbia) |

| Flavor | Sweet, rich, creamy | Sweet, tangy | Sweet, floral. | Sweet, slightly floral | Tart with sweet notes | Sweet and juicy |

| Colour | Orange yellow | Golden yellow | Deep yellow | Gold to orange-yellow | Golden yellow | Intense yellow to orange |

| Brix | 16 | 14-16 & 28 | 28 | 16-20 | 16-18 | 13-16 |

| Texture | Soft, non-fibrous, juicy | Totapuri mangoes have a firmer, denser flesh than Kent mangoes. It is high in fibre. | Smooth and creamy. Less fibre | Kent mangoes possess a softer, juicier flesh with low fibre. | Firm and highly fibrous | The texture is soft and creamy. |

| Peak availability | April, May, and June. | April, May, and June. | July & August | January, February, and December | March to July | December to February |

- Kent is the most processed variety in Peru. Peruvian mangoes like Kent are best suited for IQF and puree/concentrate. Since there is a huge slash in the volume of Kent, this season, it paves up an opportunity for Totapuri mango puree and IQF this year.

- From the above chart, we can see that Tommy Atkins and Kent are equivalent to totapuri and Magdelena is equivalent to Alphonso which is the premium variety. When it comes to Indian vs Mexican mangoes, Indian mangoes are more complex in flavour.

- In North America, the preference is for IQF Kent mangoes, while in Europe, IQF totapuri mangoes are favoured. The main factor influencing this choice is familiarity with the flavour profiles. European customers lean towards robust and tangy flavours, making Totapuri a better fit for their taste preferences. In contrast, North America opts for Kent mangoes due to their sweetness, offering a balanced combination of sugar and acidity. Additionally, the proximity of fruit sources also contributes to the decision, influencing the pricing considerations.

To be more competitive in the market, Neelam concentrate can be a better alternative to Totapuri and Peru mangoes. Neelam is an indigenous variety to India and can be considered a substitute for Totapuri and Kent if price and brix are a major consideration.

Comparing Indian Varieties: Mango comparison chart

| Characteristics | Alphonso | Neelam | Totapuri |

| Flavor | Sweet, rich, creamy | Sweet, floral. | Sweet, tangy |

| Colour | Orange yellow | Deep yellow | Golden yellow |

| Brix | 16 | 28 | 28 & 16 |

| Texture | Soft, non-fibrous, juicy | Smooth and creamy. Less fibre | Thicker and more fibrous |

| Peak availability | April, May, and June | Neelam is a late variety. available from July to August | April, May, and June. |

Alphonso vs Neelam vs Totapuri

Usage/Application of Alphonso, Kesar and Neelam.

- Alphonso is considered a premium variety and more expensive than Totapuri. It is used to differentiate products and bring strong flavours. Alphonso is predominantly used in ice creams, desserts, dairy products, and bakery and confectioneries.

- Totapuri is mainly used for juice & blends due to its tangy profile. It’s a good competitor for South American varieties like Kent and Tommy Atkins.

- Neelam is predominantly used for beverages and blends with other fruits like oranges to maintain acidity levels. It is also used in desserts as the flavour is sweet.

- Kesar is similar to Alphonso it can used for beverages and dairy applications.

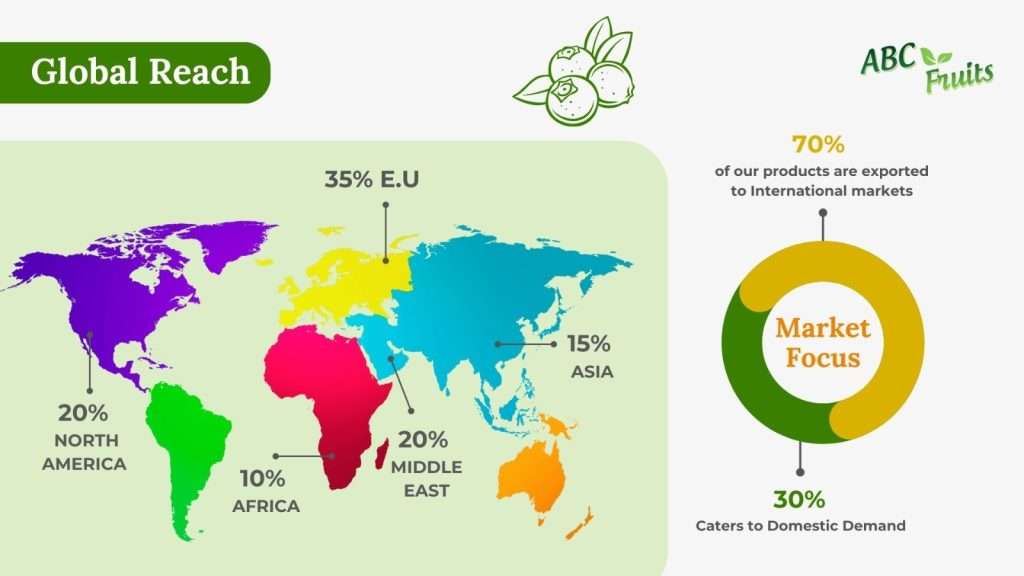

Why ABC Fruits

ABC Fruits, being a pioneer in the fruit and vegetable processing industry, has been manufacturing quality products since 1995. Our dedication to quality has propelled us to serve over 80 countries worldwide, solidifying our position as a trusted partner in the international and domestic markets.

2023 Mango puree and concentrate Production

- This year we produced a total of 50,000MT in mango single strength basis.

- With Alphonso Mango Puree strength of around 500 FCL,

- Totapuri Mango Puree single strength of around 800 FCL

- 1000 FCL of Mango Concentrate – it is easier to produce concentrate during peak season due to the consistently high supply

Main Selling Market:

The majority of mangoes are used for domestic consumption. Mango juice is a very familiar and common drink in India. Similar to Orange Juice in North America.

ABC FRUITS Product offerings

- Brix – 16 Deg

- 215kg Net wt. Aseptic bags in drums

- Gross weight: 17.2 MT (80 drums in one 20’FCL)

- Shelf life: 24 months from the date of manufacturing in ambient conditions

- Brix – 14 Deg

- 215kg Net wt. Aseptic bags in drums

- Gross weight: 17.2 MT (80 drums in one 20’FCL)

- Shelf life: 24 months from the date of manufacturing in ambient conditions

- Brix – 28 Deg

- 228kg Net wt. Aseptic bags in drums

- Gross weight: 18.2 MT (80 drums in one 20’FCL)

- Shelf life: 24 months from the date of manufacturing in ambient conditions

- Brix – 28 Deg

- 215kg Net wt. Aseptic bags in drums

- Gross weight: 8.12 MT (80 drums in one 20’FCL)

- Shelf life: 24 months from the date of manufacturing in -18 degrees Celsius

- Brix – 9-11 Deg

- 10 kg bulk pack in food grade LDPE bags packed in 5-Ply corrugated cartons.

- Other packaging options: 4*2.5kg packaging in cartons.

- Retail private label packaging.

- Gross weight: 23 MT Net can be loaded per FCL

- Shelf life: 24 months from the date of manufacturing in -18 degrees Celsius

- Brix – 15-18 Deg

- 10 kg bulk pack in food grade LDPE bags packed in 5-Ply corrugated cartons.

- Other packaging options: 4*2.5kg packaging in cartons.

- Retail private label packaging.

- Gross weight: 23 MT Net can be loaded per FCL

- Shelf life: 24 months from the date of manufacturing in -18 degrees Celsius